- Home

- About us

-

Service

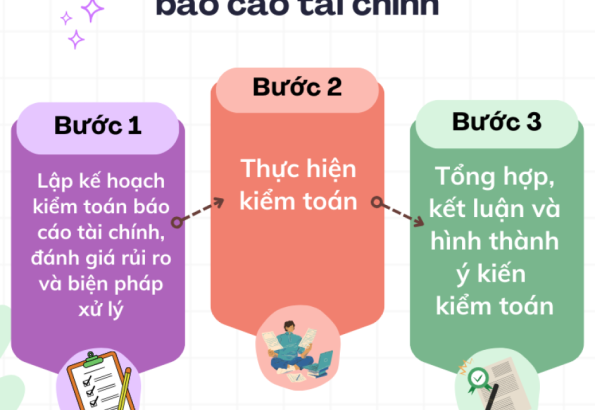

- AUDIT SERVICES

-

ACCOUNTING SERVICES

- Dịch vụ kế toán hộ kinh doanh

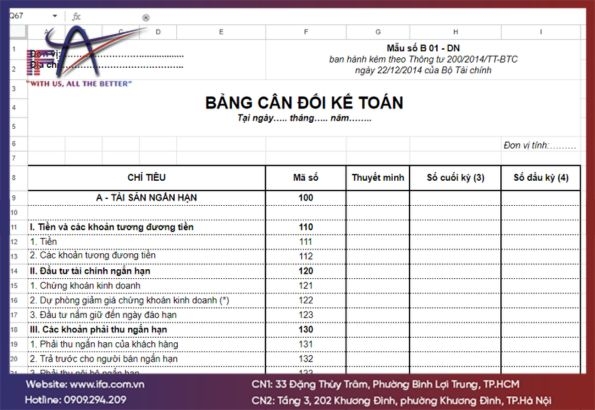

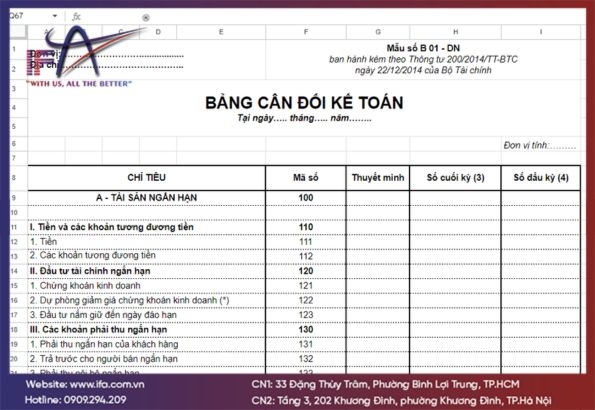

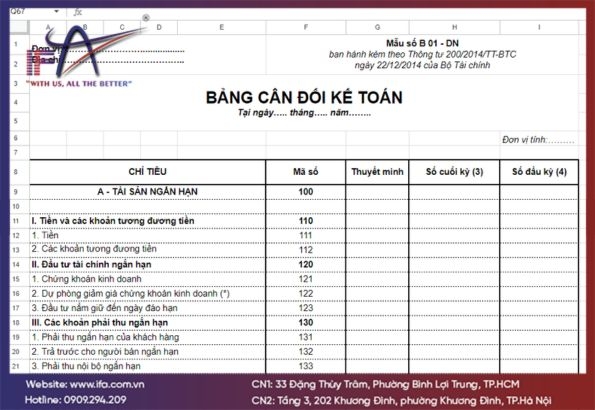

- Bookkeeping and Financial Reporting

- Review and Finalization of Accounting Books

- Accounting System Setup Consulting

- Full Accounting Service

- Professional accounting personnel supply service

- Internal accounting services

- Costing Process Conlsuting

- Payroll and insurance services

- Prepare financial reports according to IFRS

- Digital signature, electronic invoice

-

TAX CONSULTING

- Tax Compliance Consulting and Review

- Transfer Pricing Consulting

- Tax finalization support

- Tax risk management consulting

- Periodic tax consulting services

- Prepare documents to explain and apply for VAT refund

- Personal income tax finalization service

- Tax Incentive Consulting and Tax Restructuring Advisory

-

BUSINESS SUPPORT CONSULTING

- Consulting on Establishing Foreign Businesses

- Business Formation Consulting

- Mergers and Acquisitions (M&A) Advisory

- Internal Control System Development and Improvement Consulting

- Business License and Investment License Amendment

- ERP Implementation Consulting

- Periodic legal advice

- Business Dissolution Consulting and Support Services

- document

- Recruitment

- expert

- News

- Contact us

![[CẬP NHẬT MỚI] Nghị định số 90/2025/NĐ-CP: Doanh nghiệp quy mô lớn bắt buộc phải kiểm toán từ 14/04/2025 [CẬP NHẬT MỚI] Nghị định số 90/2025/NĐ-CP: Doanh nghiệp quy mô lớn bắt buộc phải kiểm toán từ 14/04/2025](thumbs/595x410x1/upload/news/dieu-kien-bat-buoc-kiem-toan-khi-dap-ung-toi-thieu-1-3278.png)